About us

years of combined

Who are we

Fortera is a firm of tax experts, chartered accountants and business advisors based in Nairobi who has a passion for responding to your needs and partnering with you in building a future together.

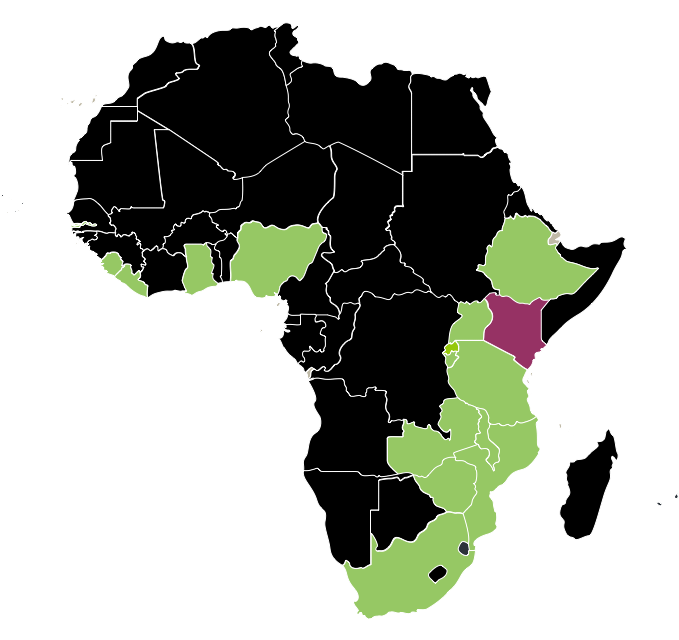

The firm currently has four directors with a combined experience of more than 40 years in taxation, accountancy and business advisory. The experience of the directors spans various industries spanning across sub-Saharan countries such as Kenya, Uganda, Tanzania, Rwanda, Ethiopia, Mauritius, Burundi, Malawi, Mozambique, Zambia, Zimbabwe, South Africa, Nigeria, Ghana, Sierra Leone, Liberia, and Gambia.

We serve a broad range of clients ranging from individuals and sole traders to large corporate businesses. At Fortera, we strive to understand your needs and challenges and formulate a bespoke solution tailored to your specific circumstances. We are passionate about what we do and how we can share our combined knowledge and experience to ensure that your financial affairs are cared for. This enables us to identify opportunities and risks at an early stage to safeguard your future.

Our experience in Africa

-

Our Mission

Our mission is to partner with you and build a future together

-

Cultures and Values

Our culture and values dictate our action in every task. We have a passion for what we do and value a personal approach to our work, driven by trusted and talented people. We work closely together with our people, client and suppliers.

Our culture is driven by the following values:

- Purpose

- Passion

- Persistence

-

We pride ourselves as

- Trusted business advisor, not just a compliance accountant

- Experienced and knowledgeable in delivering tax, accountancy, and business advisory

- Partners in building a future together

- Flexible on our fees – it’s never too serious.

Our Team

Our team boast of a combined professional experience of over forty years in tax, audit and business advisory services.

Relationships are built with people, not companies. And what’s important to you has to be important to anyone serving you. That’s why each and every Fortera team member focuses on earning the respect, confidence and trust of our clients. That’s the only way we know to deliver "Tee to Green service."

Pasquale is an experienced tax and transfers pricing professional with over 10 years of professional experience. He has advised clients on various tax matters including transfer pricing, corporate tax, withholding tax, value-added taxes, tax strategy, and tax restructuring. He has led the delivery of many assignments spanning various industries in Kenya, Uganda, Tanzania, Rwanda, Ethiopia, Nigeria, Ghana, Malawi, Mozambique, and Zimbabwe.

Pasquale has provided transfer pricing compliance and advisory services such as transfer pricing planning studies, transfer pricing compliance and defense documentation, evaluation of structuring options from a transfer pricing perspective, review and quantification of risks pertinent to related part transactions, assistance in dispute resolution and benchmarking studies.

He has also advised multinational enterprises on corporate reorganization and restructuring of transactions for efficient tax outcomes.

He has also assisted companies in preparation and submission of corporate income tax returns, value-added tax returns and withholding tax returns.

Pasquale started his career with PwC Kenya in 2008. He has worked in various capacities with PwC Kenya and PwC Nigeria and rose to the position of Senior Manager before leaving to found Fortera.

Pasquale holds a Bachelor of Science in Mathematics from the University of Nairobi and has a certificate in Transfer pricing from the Chartered Institute of Taxation from the United Kingdom. He is also a member of the Institute of Certified Public Accountants of Kenya (ICPAK).

Solomon has over 10 years of experience in Transfer Pricing and Tax Advisory offering services at a senior level in a number of countries in Africa. He is a leading expert in comparability studies and transfer pricing databases in Africa.

Solomon has also experience in tax restructuring, mergers and acquisitions, business setups and structuring, offshore entity setups, tax reviews, and Value Added Tax (VAT) refund audits. He has vast experience working with revenue authorities, government agencies and major players in key industries in the countries that he has worked in. These include oil and gas, tourism, manufacturing, banking, telecommunication, shipping and logistics, agriculture among others.

Solomon has worked with one of the big four global firms in the East African region serving its key clientele in the region. Solomon has been involved at a senior level in Transfer Pricing consulting (Benchmarking) and training Revenue Authorities and Tax Consultants across Africa. Further, he has spearheaded capacity building in the use of databases for research in Governments and private sector clients. Solomon has also assisted various clients and potential clients in the use of various software solutions and databases. One of his key achievements include establishing new relationships and revenue streams with over 18 Governments and Revenue Authorities in Africa and all the big 4 audit firms

Solomon has extremely good relationships in the tax industry including key regulatory agencies. He has vast experience dealing with tax authorities and very good at arguing clients’ positions and presentations. He has represented clients in meetings with various regulatory agencies in a number of countries.

Solomon holds an LLB from Moi University and LLM (Mercantile Law) LLM (International Tax Law) both from the University of Pretoria. He also has a Postgraduate Diploma in Law from the Kenya School of Law and thus an Advocate of the High Court of Kenya.

Gabriel has over 11 years professional experience in offering accounting, tax, and business advisory services. He has worked both in professional services environment and more recently industry looking after the company’s tax affairs. His work in the industry also involved advising management on tax matters and supporting the commercial and planning teams with respect to tax matters.

Gabriel spent over 9 years with PwC. He had a 4-year stint with PwC Ghana. He has extensive experience in tax structuring, business set-ups, and structuring. He was involved in several assignments for extractives sector (oil and gas and mining), these include review of contracts to advise on the tax implications of transactions and contract structuring for tax planning optimization, carrying out due diligence assignments and tax reviews covering corporate taxes, VAT, PAYE, withholding taxes, customs, and excise taxes, assisting companies in resolution of tax dispute with revenue authorities.

He has lead several assignments for Mergers & Acquisitions (M&A), Corporate structuring and re-organizations, Vendor and Buyer Tax due diligence. He also has extensive experience in servicing industries in the manufacturing sector, agricultural sector, non-governmental organizations (NGO), financial services, extractives sectors. In Ghana he worked for Energy and Mining clients, Telecommunications and Real Estate sector.

Gabriel has been a presenter in several forums including the 4th IBFD Africa Tax Symposium, 2018 Annual Tax Summit organized by the KRA.

Gabriel is a Fellow of the Association of Chartered Certified Accountants and holds an Advanced Diploma in International Taxation. He also has a Postgraduate Certificate in Mechanics of Project Finance from Middlesex University.

Jurgen has extensive experience in providing policy advisory, tax advisory, and regulatory compliance services for over the last 10 years to large and multifaceted clients having worked in the PwC Kenya, Nairobi. In the years 2008 to 2015 he worked as a Tax Manager at PwC Kenya playing a leading role in the provision of compliance, consulting and advisory services about taxes covering direct and indirect taxes to local and multinational clients. He has also widely consulted for the East African Community (EAC) Secretariat in areas of tax policy review and tax policy harmonization.

In 2016-2018 Jurgen worked with British American Tobacco (BAT) as the manager in charge of legal and external affairs for Eastern Africa Markets leading a cluster of 14 countries. He led in tax planning as well as tax forecasting for planning purposes. He was also in charge of lobbying the government for changes in tax laws across the Eastern Africa Markets. Significantly, In Uganda, he led the development of internal compliance procedures to meet the requirements for the Uganda Tobacco Control Act in 2016 as well as the Excise Duty Amendment Act 2017. He led the team that successfully challenged the implementation of the Uganda Excise Duty Act 2017 at the East Africa Court of Justice.

He brings to your business a detailed understanding of regional tax laws, cross border trade, tax treaties and their impact on taxation. He will also offer a good understanding of the operations of multinational businesses and cross and their tax considerations. As well as the operations of regional economic blocs. His expertise in stakeholder mapping, stakeholder management, and regulatory monitoring will be of great impact to the company.

Jurgen holds a Bachelors’s Degree in Biochemistry, is a Member of ACCA and certified Miller Heiman professional in strategic and conceptual selling.